Ira Limits 2025 Catch Up Contribution

Ira Limits 2025 Catch Up Contribution. For 2025, the annual contribution limits on iras remains $7,000. The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

For the 2025 tax year, the contribution limits will remain the same as 2025: The 401(k) contribution limit for 2025 is $23,500, up from $23,000 in 2025.

Maximum Ira Contribution 2025 Catchup Edith Heloise, This is a $500 increase over the 2025 limit, as previously noted.

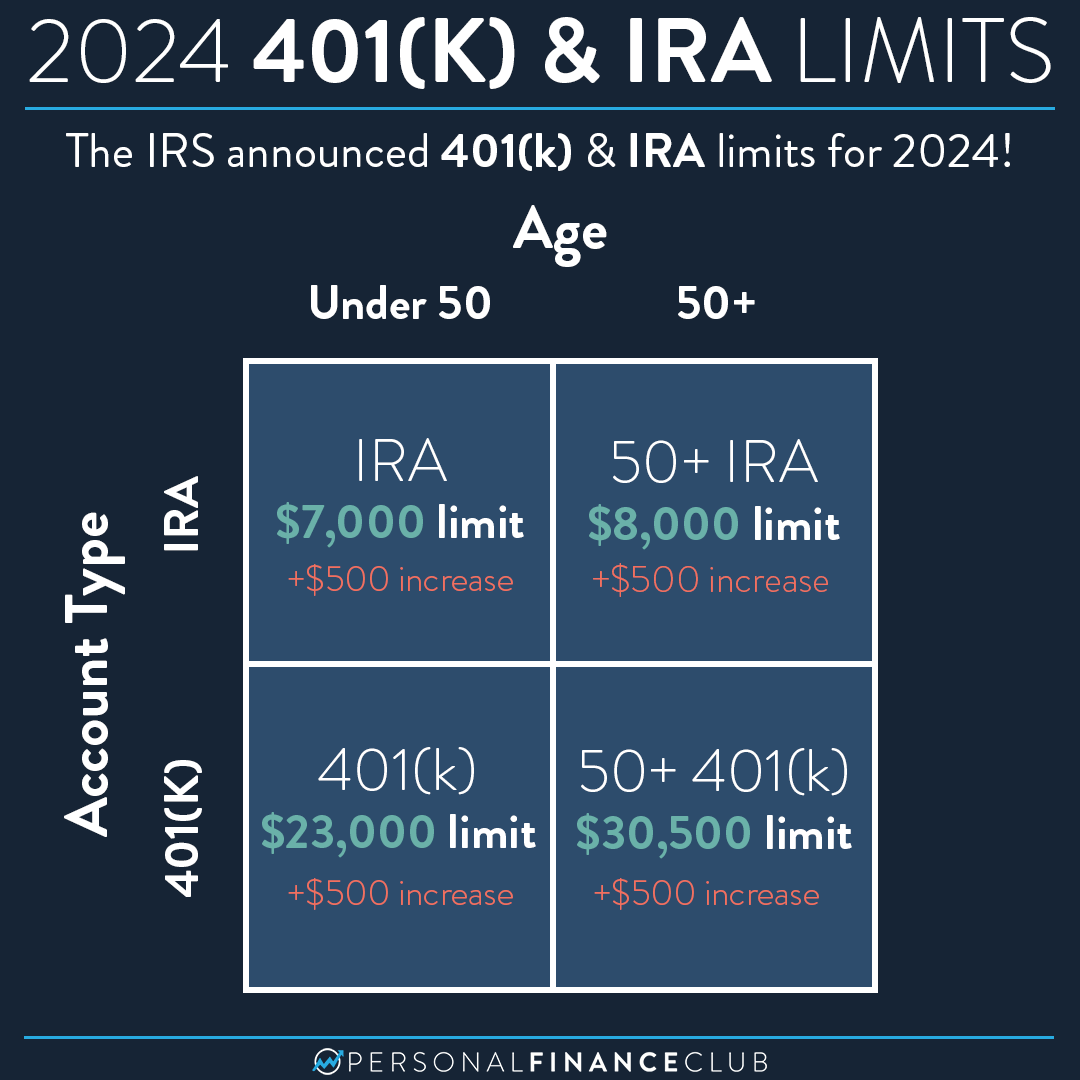

2025 401(k) and IRA contribution limits announced! Personal Finance Club, The limit on annual contributions to an ira remains $7,000.

2025 Simple Ira Contribution Limits 2025 Danna Yoshiko, The limit on annual contributions to an ira remains $7,000.

Irs 401k Catch Up Contribution Limits 2025 Joell Madalyn, Ira contribution limits unchanged for 2025.

Higher IRA and 401(k) Contribution Limits for 2025 PPL CPA, If you're age 50 and older, you can add an extra $1,000.

IRA Contribution Limits in 2025 Meld Financial, For 2025, the annual contribution limits on iras remains $7,000.

Maximizing your 2025 IRA Contribution Limits New IRA Rules, The standard 2025 maximum ira contribution limit is $7,000.

IRA Contribution Limits for 2025, 2025, and Prior Years, While the ira contribution limit is the.

Roth Ira Catch Up Contribution Limits 2025 Celka Clarine, Savers over 50 may contribute an additional $1,000, also the same as in 2025.

2025 IRA Maximum Contribution Limits YouTube, The combined annual contribution limit in 2025 for a traditional and roth ira is $7,000 for those younger than age 50 and $8,000 for those 50 and older (since the latter are eligible for.